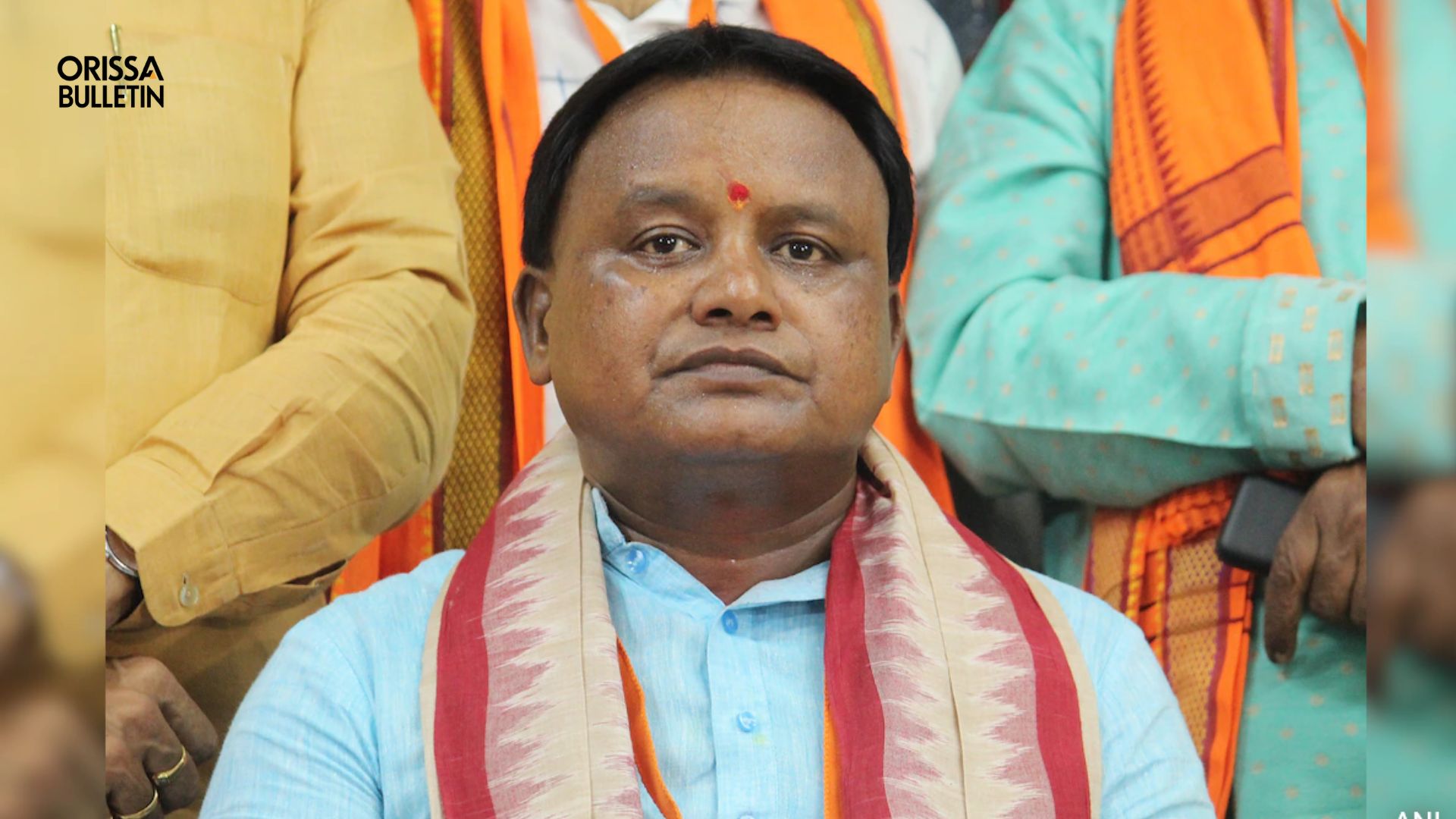

Odisha Chief Minister Mohan Majhi recently revealed a surprising personal story. He disclosed that he was a victim of the infamous chit fund scam. This scandal affected thousands of people across the state and left many investors devastated. At an event for National Consumer Day, Majhi opened up about his experience. His revelation highlights how widespread the impact of the scam was, affecting even those in positions of power.

Mohan Majhi’s Experience

During his speech, Majhi admitted that he had invested money in two chit fund companies. One was state-run, and the other was a private firm. This investment took place between 1990 and 2002. Majhi later found out that both companies had disappeared without a trace. He said, “I was duped by these chit fund firms, and like many others, I too lost my hard-earned money.” This admission reveals how deceptive these companies were and how they exploited ordinary citizens.

Majhi detailed his frustrations in trying to recover his funds. The old chit fund laws made the recovery process complex and ineffective. Despite multiple attempts to seek redress, he found the legal system to be long-winded and filled with challenges. Many investors faced similar situations, echoing his struggles.

Government’s Role in Addressing the Issue

Amid this, Majhi praised the current BJP-led government at the Centre. He especially highlighted Prime Minister Narendra Modi’s involvement in amending the Chit Funds Act of 1982 in 2019. These amendments were essential in closing legal loopholes that had previously allowed fraudulent firms to operate without regulation. Majhi acknowledged the importance of these changes. He stated, “Under the leadership of Prime Minister Modi, all the loopholes in the law were closed.”

This comment emphasizes the government’s commitment to improving protections for investors. It shows an awareness of the past failings of the chit fund system.

The Scale of the Chit Fund Scam

The chit fund scam has been one of the largest financial scandals in Odisha. It left lakhs of investors in financial ruin. Many companies promised high returns to attract investment but then vanished after collecting vast sums. Notable firms involved in this scam included Seashore, Aartha Tatwa, Rose Valley, and Micro. Reports estimate that these companies defrauded investors in Odisha out of Rs 4,600 crore.

The Central Bureau of Investigation (CBI) and the Odisha Crime Branch conducted investigations into these companies. Their findings revealed that substantial funds had been raised over many years. The situation escalated so much that in 2014, the Supreme Court of India intervened. The court ordered a thorough investigation into the Saradha Group and 44 other chit fund firms operating in the region.

The outrage from the public was immense. Many demanded stronger regulatory measures to protect depositors. In response to this public sentiment, the Odisha government initiated steps to address the issue. Under Chief Minister Naveen Patnaik, the government focused on mitigating the damage caused by the fraud.

State Government’s Response and Relief for Victims

In 2013, the Odisha government established the Justice MM Das Commission. This commission aimed to investigate the chit fund scam thoroughly. It identified around 100,000 small depositors who had been defrauded. To assist these victims, the state government set up a Rs 300 crore corpus fund. This fund specifically aimed to refund amounts to small depositors, particularly those who had lost Rs 10,000 or less.

Since this fund’s creation, significant progress has been made in returning money to affected individuals. Official reports state that about 2 lakh small investors have already received compensation. This financial relief was made possible through the seizure and auctioning of properties from three major chit fund firms: Rose Valley Group of Companies, Golden Land Developers Group of Companies, and Hi-Tech Estates Group of Companies. The confiscated assets were sold off to help compensate the victims.

Ongoing Challenges

Despite these government efforts, many challenges remain. The process to ensure full compensation for all victims is still ongoing. Many individuals, particularly those who lost larger sums, are still waiting for justice. The scale of the fraud, combined with the complexities of financial crime, complicates the situation.

The Odisha government’s crackdown on 342 chit fund companies demonstrates progress. However, the journey to restore funds and achieve justice continues. Law enforcement agencies remain committed to pursuing perpetrators to ensure accountability.